non home equity loan texas

2 will be with recourse for personal liability against you and your spouse. You may have the option to refinance your home.

How To Get A Home Equity Loan With Bad Credit Bankrate

For Wall Street Journal WSJ Prime call 866-376-7889.

. In 1997 Texas for the first time allowed homeowners to use the equity in their home as collateral for unrestricted cash borrowing. A home equity loan is a special form of a home mortgage that allows a homeowner to borrow against home equity the difference between the. Home Equity loans are limited to 80 of the homes fair market value less the.

Low interest home equity best heloc in texas home equity. HELOCs in Texas work similarly to home equity loans. Home Equity Loan Texas Oct 2022.

If you want to get another loan. FNMA TX Mortgage Basics 15 year 20 year 25 year or 30 year fully. Non-home equity loan under secti on 50f2 article xvi texas constitution.

In Texas it is commonly referred to as a Texas Cash Out. Maximum term on non-owner occupied properties is 15 years. The Non-Home Equity program Texas 50a4 allows for a rate or term refinance of an existing Texas Home Equity loan.

For home equity loans sought to be refinanced as a non-home equity loans under Article XVI Section 50a4 the new notice required by Section 50f2D must be provided within three. The home must be in Texas and be single-family owner occupied. Frost Home Equity Loan rates shown are for the 2nd lien position.

Best Home Equity Loans In Texas - If you are looking for options for lower your payments then we can provide you with solutions. The loan increases the lien on the borrowers house and reduces the amount of equity they have in their home. And 3 may also.

By BMG Memorandum Jan 3 2018 Client and Friends Memos Forms Texas Home Equity Texas. 1st lien products are available. Equity Home Loans are available for properties located in California Arizona.

A home equity loan can give you the chance to borrow against the equity in your home. That includes houses condos townhomes or duplexes. CUTX does not provide home equity loans or.

TEXAS HOME EQUITY F2 NOTICE FOR NON-HOME EQUITY. The constitutional amendment did not define what constituted a fee for purposes of a home equity loan and this ambiguity has created much concern among lenders. You can only have one outstanding equity loan.

This stems from Texass longstanding protection of. If youre a Texas homeowner in search of an affordable financing option consider a home equity loan. Compare rates terms and our full range of financing options.

Use our Help Me Choose tool to find the right home equity product for you. Home Equity Loan Texas - If you are looking for a way to reduce your expenses then our trusted service is just right for you. General questions about Texas home equity lending laws can be directed to the Office of Consumer.

Your existing loan that you desire to refinance is a home equity loan. The state banned home equity loans as late as 1997 and continues to subject lenders to far stricter constraints than most other states. Loans available on 1-4 family dwellings.

How Home Equity Loans Work in Texas. Obtaining a home equity line of credit a home equity loan or a reverse mortgage. 1 will permit the lender to foreclose without a court order.

So you can only borrow up to 80 of. 1 Minimum loan amount is 25000 for first-lien home equity loans. There are significant limitations on this type of loan the most.

Texas law permits that you can only have one home equity loan or one cash-out refinance loan at a time. Ask a Frost Banker for details. A non-home equity refinanced loan.

Terms up to 15 years available. Texas law requires that all HELOCs have a maximum loan-to-value ratio of 80. Home equity lending in Texas was allowed by an amendment to the Texas Constitution approved by the voters on November 4 1997 and became effective January 1 1998.

Texas Home Equity Loan Guidelines

Main Things You Should Know About Home Equity Loans

Texas Home Equity F2 Notice For Non Home Equity Black Mann Graham L L P

6 Best Home Equity Loan Lenders Of 2022 Nerdwallet

Texas Home Equity Loan Rules Everything You Need To Know

Texas Home Equity Loan Guidelines

Best Home Equity Loan Lenders Of October 2022 Forbes Advisor

A Good Day For Lenders Texas Supreme Court Rules That Lenders Still Entitled To Equitable Subrogation For Non Compliant Home Equity Loans Financial Services Perspectives

How Does A Home Equity Loan Work In Texas

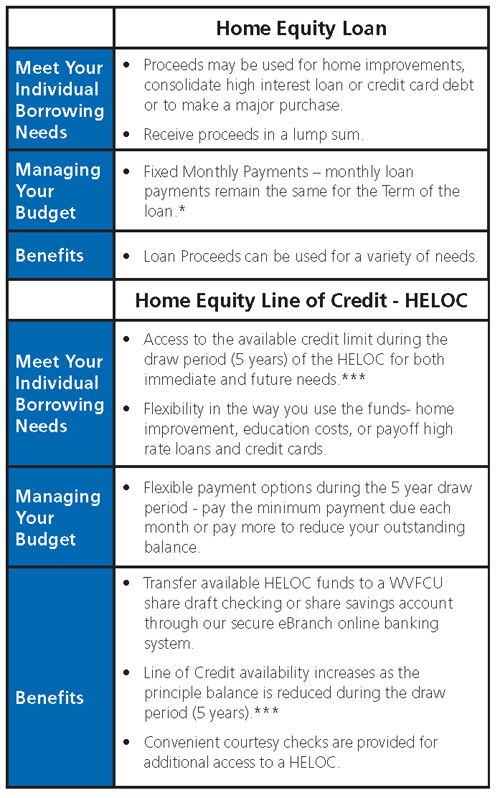

West Virginia Federal Credit Union Home Equity Loans West Virginia Fcu

Home Equity Loan Credit Union Of Texas

Home Equity Loan Vs Heloc To Fund Home Improvements

Are There Va Home Equity Loans Explore The Options Lendingtree

Home Equity Loans In Texas Texas Cash Out Texas Home Loans

Texas Home Equity Loan Guidelines

Home Equity Vs Refinance Hel Heloc Refinance Better Mortgage

Open A Home Equity Line Of Credit Heloc Truist

Home Equity Loans Texas Credit Union Low Interest Rates Crcu